Conventional Mortgage Loans: The Preferred Selection for Homebuyers

Conventional Mortgage Loans: The Preferred Selection for Homebuyers

Blog Article

Recognizing the Different Kinds of Mortgage Offered for First-Time Homebuyers and Their Unique Advantages

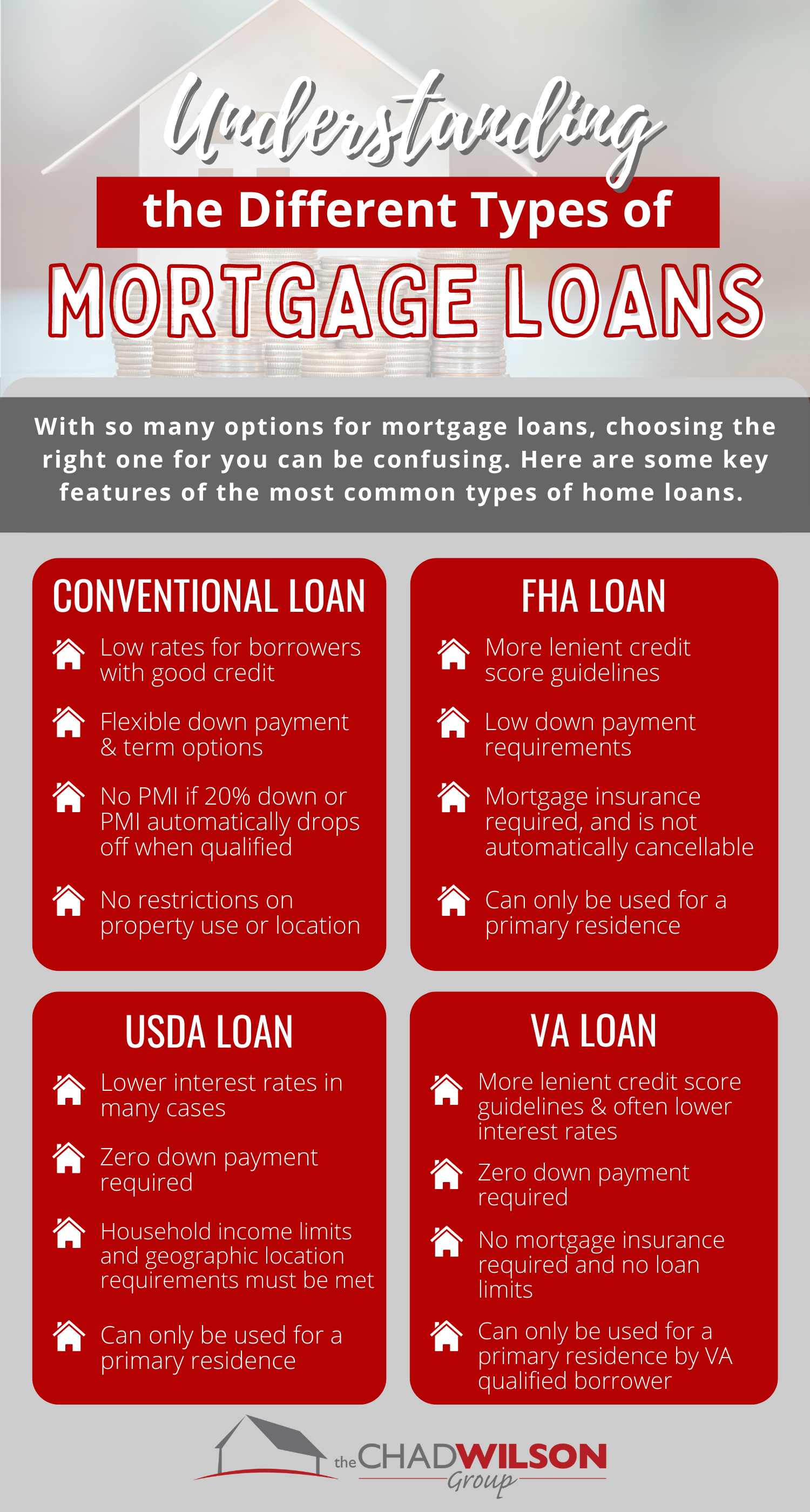

Browsing the variety of home mortgage financing choices readily available to newbie buyers is crucial for making enlightened economic choices. Each kind of financing, from standard to FHA, VA, and USDA, offers one-of-a-kind advantages tailored to diverse buyer needs and circumstances.

Conventional Loans

Traditional lendings are a foundation of mortgage funding for first-time property buyers, providing a trusted option for those aiming to purchase a home. These finances are not insured or assured by the federal government, which differentiates them from government-backed loans. Usually, standard car loans call for a greater credit history rating and a more considerable deposit, typically varying from 3% to 20% of the purchase price, depending upon the lending institution's needs.

One of the considerable advantages of traditional loans is their flexibility. Debtors can select from various car loan terms-- most frequently 15 or three decades-- allowing them to straighten their home loan with their economic objectives. In addition, standard finances might supply reduced interest rates compared to FHA or VA lendings, especially for customers with strong credit score accounts.

One more benefit is the absence of in advance mortgage insurance premiums, which prevail with government loans. However, private mortgage insurance coverage (PMI) may be required if the down settlement is much less than 20%, however it can be eliminated once the borrower attains 20% equity in the home. Generally, conventional lendings present a sensible and eye-catching funding choice for first-time buyers seeking to navigate the home mortgage landscape.

FHA Finances

For numerous new homebuyers, FHA finances represent an available path to homeownership. One of the standout attributes of FHA car loans is their reduced down payment demand, which can be as reduced as 3.5% of the acquisition price.

Additionally, FHA finances permit higher debt-to-income ratios compared to traditional financings, accommodating customers that might have existing economic commitments. The rate of interest related to FHA loans are frequently competitive, additional boosting affordability. Customers also take advantage of the capability to include specific closing expenses in the finance, which can reduce the ahead of time economic burden.

However, it is necessary to note that FHA lendings require mortgage insurance premiums, which can raise month-to-month settlements. Regardless of this, the total advantages of FHA finances, consisting of availability and lower initial costs, make them an engaging choice for newbie property buyers seeking to get in the realty market. Understanding these loans is crucial in making notified choices about home financing.

VA Loans

VA loans supply an unique funding service for qualified experts, active-duty service participants, and particular members of the National Guard and Gets. These loans, backed by the united state Department of Veterans Matters, give numerous benefits that make own a home extra obtainable for those who have served the nation

One of the most substantial benefits of VA loans is the absence of a deposit requirement, permitting qualified customers to fund 100% of their home's acquisition price. This function is especially beneficial for first-time property buyers that may battle to save for a considerable down payment. In addition, VA finances generally feature competitive rates of interest, which can cause reduce monthly repayments over the life of the finance.

Another notable benefit is the lack of private home mortgage insurance policy (PMI), which is commonly called for on traditional finances with reduced deposits. This exemption can cause substantial savings, making homeownership more affordable. Additionally, VA lendings supply flexible credit report demands, enabling customers with lower credit history to qualify even more quickly.

USDA Finances

Discovering funding alternatives, first-time property buyers might locate USDA car loans to be an engaging option, particularly for those seeking to purchase home in country or rural locations. The United States Division of Farming (USDA) uses these loans to promote homeownership in marked country regions, supplying an exceptional chance for qualified customers.

One of the standout functions of USDA car loans is that they require no down settlement, making it less complicated for newbie buyers to go into the real estate market. Additionally, these financings typically have competitive rate of interest, which can result in reduce month-to-month settlements contrasted to standard funding choices.

USDA loans likewise come with adaptable credit needs, enabling those with less-than-perfect credit rating to qualify. The program's revenue restrictions ensure that aid is directed towards reduced to moderate-income family members, further sustaining homeownership objectives in rural areas.

Furthermore, USDA fundings are backed by the federal government, which reduces the danger for loan providers and can streamline the approval procedure for customers (Conventional mortgage loans). Therefore, first-time property buyers taking into consideration a USDA loan may find it to be a obtainable and useful option for accomplishing their homeownership desires

Unique Programs for First-Time Buyers

Many novice homebuyers can profit from special programs created to assist them in navigating the intricacies of acquiring their initial home. These programs usually offer financial motivations, education and learning, and resources tailored to the one-of-a-kind demands of novice buyers.

In Addition, the HomeReady and Home Feasible programs by Fannie Mae and Freddie Mac deal with reduced to moderate-income buyers, supplying adaptable home mortgage choices with decreased home loan insurance prices.

Educational workshops held by various organizations can also help first-time buyers recognize the home-buying procedure, enhancing their possibilities of success. These programs not only alleviate monetary burdens yet likewise equip customers with expertise, eventually facilitating a smoother transition into homeownership. By exploring these unique programs, novice buyers can uncover beneficial resources that make the desire for having a home more possible.

Verdict

Conventional loans are a cornerstone of home loan funding for novice homebuyers, giving a reputable option for those looking to purchase a home. These financings are not guaranteed or ensured by the federal government, which differentiates them from government-backed loans. Additionally, standard fundings might use lower interest prices contrasted to FHA or VA financings, especially for debtors with solid credit history profiles.

In see this site addition, FHA car loans allow for greater debt-to-income ratios compared to conventional loans, accommodating customers who find out this here might have existing economic commitments. Additionally, VA finances usually come with affordable passion prices, which can lead to reduce month-to-month payments over the life of the car loan.

Report this page